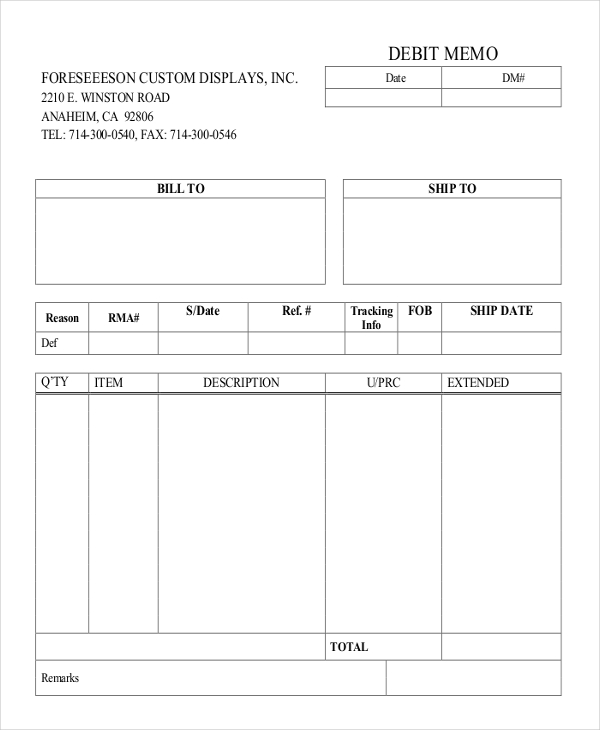

Here are some types of accounts offered by banks and credit unions aren’t DDAs. Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from dda debit memo advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. Some people consider savings accounts to be DDAs, but there’s a difference to note.

Unlocking Creativity: How Essay and Content Creator Resources Empower Writers

- Some people consider savings accounts to be DDAs, but there’s a difference to note.

- In an era where competitors are just a click away and customer loyalty is harder than ever to earn, a single fraud incident can have lasting repercussions.

- A bank uses a “force pay” code to give a debited item priority over other pending transactions that haven’t cleared out of your account yet.

- On the other hand, you can access the money in a demand deposit account whenever you like.

Like demand deposit accounts, funds in time deposit accounts can be protected at financial institutions with FDIC or NCUA coverage. As with other types of deposit accounts, the FDIC insures demand deposit accounts (up to $250,000, depending on different variables). Because they’re FDIC insured, DDAs can help keep your money safe until you’re ready to spend it.

MANAGING YOUR MONEY

But Sigma Identity Fraud is more than just a powerful fraud prevention tool. It is also designed to help you streamline operations, reduce false positives, and enhance the customer experience. The platform’s real-time decisioning capabilities allow for swift action to be taken when fraud is detected, minimizing losses and protecting the institution’s reputation. And by accurately verifying identities and reducing friction in the customer onboarding process, Sigma Identity Fraud can help institutions improve conversion rates and attract new customers. The consequences of DDA fraud are severe and financial losses are just the beginning. Fraud can also damage a financial institution’s reputation, erode customer trust, and lead to costly regulatory penalties.

What Is a Consumer DDA Account?

This includes traditional savings accounts at brick-and-mortar banks, as well as high-yield savings accounts offered by online banks. Between the two, online banks tend to offer better rates to savers, as they usually have lower overhead costs. Rules have changed since then and now it’s legal for demand deposit accounts like checking accounts to earn interest.

DDA Account Types

They empower account holders with powerful tools and features that simplify banking tasks and provide increased control and transparency over their DDA accounts. The federal government uses demand deposits to measure how much liquid cash is available in the U.S. money supply chain. This measure of money is referred to as “M1” and is the sum of all demand deposits, currency, and other liquid deposits held at financial institutions.

Editorial integrity

Visit Socure’s website to learn more about Sigma Identity Fraud and our comprehensive approach to identity verification and fraud prevention. Our resource center offers in-depth insights and case studies that demonstrate the real-world impact of our solutions. If the credit balance is considered material, the company most likely will issue a refund to the customer instead of creating a debit memo.

Opening a demand deposit account essentially just means opening a checking account. You’ll need to meet the bank’s minimum requirements to open an account, including providing your personal information and making your initial deposit. There are also time deposit accounts and negotiable order of withdrawal (NOW) accounts. Understanding how each one works is important when deciding where to keep your money.

The most common example of a time deposit account is a certificate of deposit (CD). With CDs, you can commonly choose between terms as short as 28 days or as long as 10 years, depending on what your bank or credit union offers. Unlike demand deposits, time deposits require you to retain money in the account for a specific period before it clears for use. And, for the amount of time the money needs to stay in the account, the bank will pay you interest. A checking account is typically an integral part of one’s personal finances, as this account allows you to deposit paychecks, pay bills, make debit card purchases, send money to others and withdraw cash.

While many banks impose daily ATM and purchase limitations (amounts vary bank by bank), account holders don’t feel restrained on most days. DDA account types refer to “demand deposit accounts,” which are bank accounts where funds can be withdrawn without notice. The DDA account holders have the total authentication and power to operate a debit account. They need no prior notice before the utilization of the DDA debit account. Time deposit accounts, also known as term deposit accounts, are designed for holding your money for a set amount of time.

Depending on the asset in question, it may take a day or two for the investments to be sold and the cash to be available. A demand deposit account (DDA) is a bank account from which deposited funds can be withdrawn at any time, without advance notice. DDA accounts can pay interest on the deposited funds but aren’t required to. If your demand deposit account is a traditional checking account, you can spend your money with a debit card, checkbook, transfers, or even peer-to-peer payment apps. Each bank will have its own terms and conditions, but some accounts may pay interest, some may charge fees, and some may grant you fee-free access at certain ATMs, so you can grab your money on the go.